The construction of MEHAK JEEVAN AFFORDABLE HOUSING PROJECT started in August, 2018. Project Area around 2.5 Acres. The project has approx. 413 flats in all having three towers (G+13 storeys) comprising of 1 BHK, 2 BHK, and 3 BHK flats ranging from ₹ 20.72*/- Lakhs to ₹ 44.95*/- Lakhs respectively, which are being constructed to cater primarily to the needs of low and middle income groups.

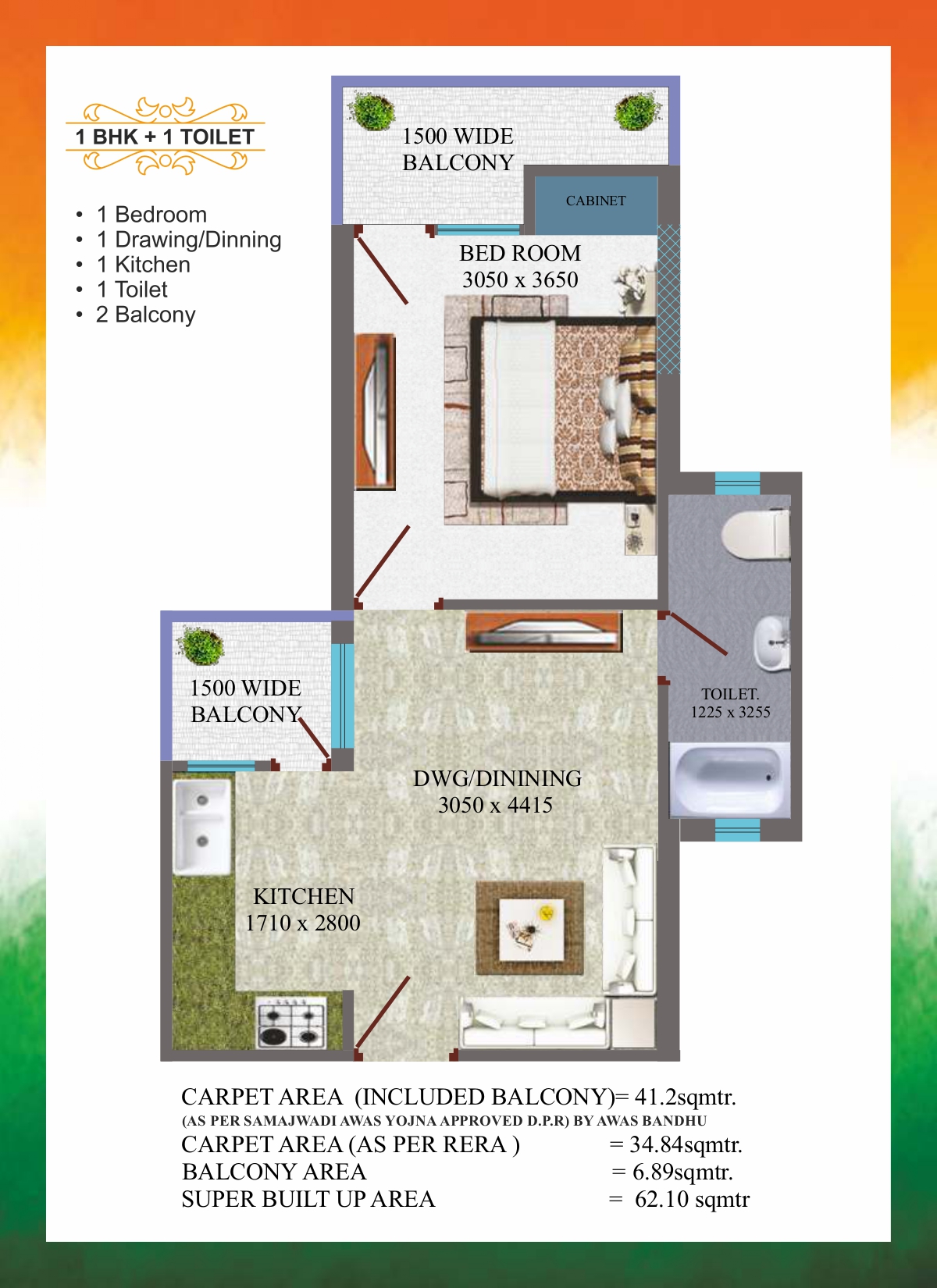

162 Apartments of Approximately 41.2 sq.mtr of Carpet Area (Included Balcony) and - Total Area of Super Built Up Area - 62.10 sq.mtr.

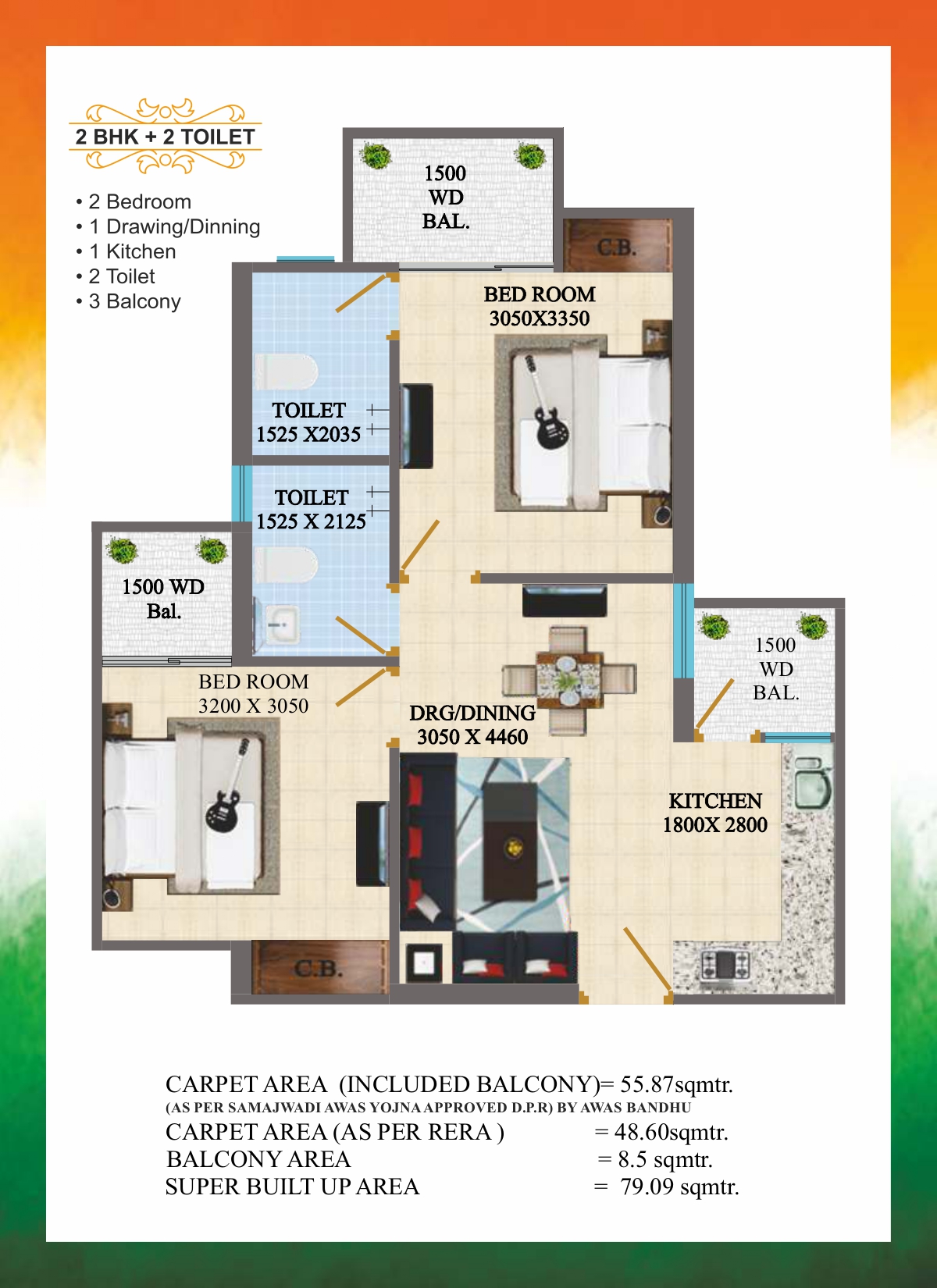

196 Apartments of Approximately 55.87 sq.mtr of Carpet Area (Included Balcony) and - Total Area of Super Built Up Area - 79.09 sq.mtr.

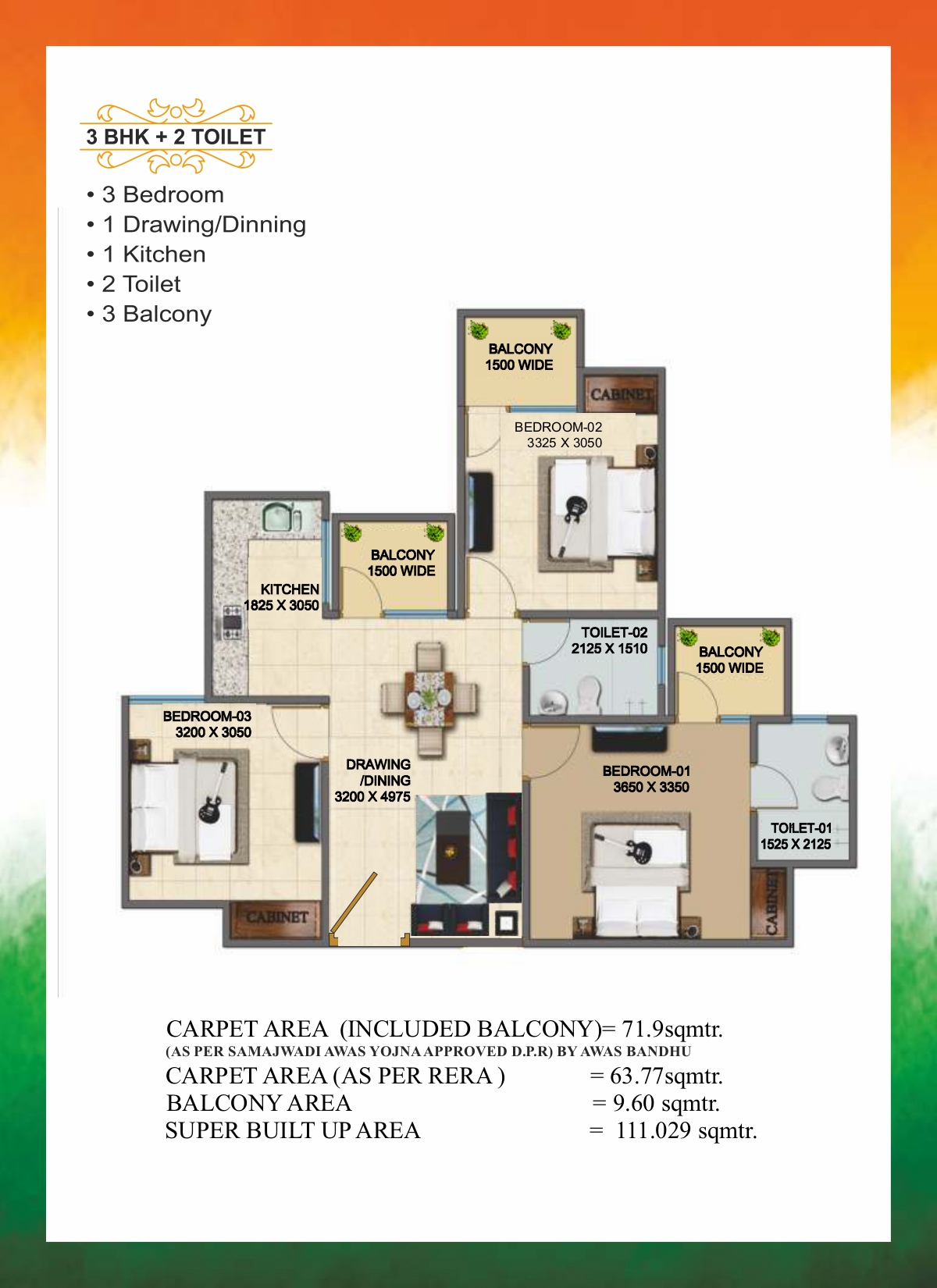

54 Apartments of Approximately 71.9 sq.mtr of Carpet Area (Included Balcony) and - Total Area of Super Built Up Area - 111.029 sq.mtr.

Super Built-up Area

62.10 Sq.Mt

Bedroom

1

Drawing/Dinning

1

Bathroom

1

Balcony

2

Super Built-up Area

79.09 Sq.Mt

Bedroom

2

Drawing/Dinning

1

Bathroom

2

Balcony

3

Super Built-up Area

111.029 Sq.Mt

Bedroom

3

Drawing/Dinning

1

Bathroom

2

Balcony

3

Booking Amount: 5% of Cost of Flat.

Booking Amount: 5% of Cost of Flat. After getting sanction of home loan: 5% of Total flat cost.

After getting sanction of home loan: 5% of Total flat cost. Bank Home Loan 90% (Subject to loan eligibility); 85% of Total flat cost.

Bank Home Loan 90% (Subject to loan eligibility); 85% of Total flat cost. On Offer of possession: 5% of Total flat cost + possession charges as applicable.

On Offer of possession: 5% of Total flat cost + possession charges as applicable. Cost and Payment plan can be changed without earlier notification; at sole attentiveness of the organization. Kindly confirm with the company helpline. However flat prices are firm and escalation free for the sold units.

Cost and Payment plan can be changed without earlier notification; at sole attentiveness of the organization. Kindly confirm with the company helpline. However flat prices are firm and escalation free for the sold units. Government charges & taxes (if any) as applicable. Please pay the attention that, if any changes in tax & charge structure beacuse of government strategies & policies will bring about in revised payment, which will be pertient to ypur booking and will be charged additionaly during the process of possesion or ownership of ready- to move-in flats.

Government charges & taxes (if any) as applicable. Please pay the attention that, if any changes in tax & charge structure beacuse of government strategies & policies will bring about in revised payment, which will be pertient to ypur booking and will be charged additionaly during the process of possesion or ownership of ready- to move-in flats. Application forms are available at Head Office (Kaushambi, Ghaziabad) or Mehak Jeevan Site office (Raj Nagar Extension, Ghaziabad)

Application forms are available at Head Office (Kaushambi, Ghaziabad) or Mehak Jeevan Site office (Raj Nagar Extension, Ghaziabad)  Applications form would be accepted along with application money as per booked unit size through Demand Draft/ Online Payment only.

Applications form would be accepted along with application money as per booked unit size through Demand Draft/ Online Payment only. The applicant should be a resident of India.

The applicant should be a resident of India.

He/She ought to have finished 18 years old on the date of submitting the application.

He/She ought to have finished 18 years old on the date of submitting the application. One person can submit one application just either in his/her own name or as a joint candidate.

One person can submit one application just either in his/her own name or as a joint candidate. The applicant ought to give points of interest of his/her investment account in any Bank and the specifics of the Account should be given alongside the 'Application Form'.

The applicant ought to give points of interest of his/her investment account in any Bank and the specifics of the Account should be given alongside the 'Application Form'. Applicant should have a Permanent Account Number (PAN) assigned under the provisions of Income Tax Act and a similar should be quoted in the Application Form.

Applicant should have a Permanent Account Number (PAN) assigned under the provisions of Income Tax Act and a similar should be quoted in the Application Form. Fragmented/Invalid/Illegible application structures are probably going to be dismissed. No correspondence in such manner will be engaged.

Fragmented/Invalid/Illegible application structures are probably going to be dismissed. No correspondence in such manner will be engaged. Self attested copy of PAN Card (Permanent Account Number) issued/allotted by Income Tax Department. In respect of successful allottees, the PAN Card details will be verified, before issuance of allotment letter

Self attested copy of PAN Card (Permanent Account Number) issued/allotted by Income Tax Department. In respect of successful allottees, the PAN Card details will be verified, before issuance of allotment letter Identity Proof e.g. self-attested copy of passport, government Identity Card, Election ID card, Driving License, Ration Card with photo (of the person whose photo is affixed) or Aadhaar Card (Provide any one).

Identity Proof e.g. self-attested copy of passport, government Identity Card, Election ID card, Driving License, Ration Card with photo (of the person whose photo is affixed) or Aadhaar Card (Provide any one). Proof of residence e.g. self-attested copy of passport, government Identity Card, Election ID card, Ration card, Driving License, Telephone Bill, Electricity Bill, Water Bill, House Tax Receipt, Bank Pass Book (page carrying name and address) or Aadhaar Card (Provide any one).

Proof of residence e.g. self-attested copy of passport, government Identity Card, Election ID card, Ration card, Driving License, Telephone Bill, Electricity Bill, Water Bill, House Tax Receipt, Bank Pass Book (page carrying name and address) or Aadhaar Card (Provide any one). Proof of income to be submitted with bank account statement for bank loan purpose (latest six months).

Proof of income to be submitted with bank account statement for bank loan purpose (latest six months).Bank Loan (up to 90% of the unit cost – subject to applicant(s) eligibility and norms of lender are available from various nationalized/private banks and NBFC’s.

Rebate on Home Loan interest - PMAY CLSS (Credit Linked Subsidy)- subject to eligibility and norms of the lender (fulfilling PMAY terms & conditions)- upto a maximum of Rs. 2.67 Lacs.

Rebate on Home Loan interest - PMAY CLSS (Credit Linked Subsidy)- subject to eligibility and norms of the lender (fulfilling PMAY terms & conditions)- upto a maximum of Rs. 2.67 Lacs. Finance Minister has announced an additional Income Tax deduction of Rs 1.5 lakh on affordable home loans. As per the proposal, income tax payers will get tax rebates of around Rs 3.5 lacs on loans of up to Rs 45 lakh borrowed upto March 31, 2020.

Finance Minister has announced an additional Income Tax deduction of Rs 1.5 lakh on affordable home loans. As per the proposal, income tax payers will get tax rebates of around Rs 3.5 lacs on loans of up to Rs 45 lakh borrowed upto March 31, 2020.Mehak Jeevan reserves the right to alter any terms and conditions/clause of the Scheme brochure at its discretion as and when considered necessary. Mehak Jeevan reserves the right to increase or decrease the number of flat on offer under the Scheme. Mehak Jeevan also reserves the right to withdraw some/all flats depending on the circumstances. The allotment under this Scheme shall be on the terms and conditions contained in the brochure, demand-cum-allotment letter.